The Heartbeat of Fandom: Exploring the World of Fans The Heartbeat of Fandom: Exploring the World of Fans Fans –...

The Fan Community: Uniting Enthusiasts WorldwideThe Fan Community: Uniting Enthusiasts Worldwide

The Power of Fandom: Exploring the World of Fans The Power of Fandom: Exploring the World of Fans Fans –...

Exploring the Enchanting Realms of Fiction NovelsExploring the Enchanting Realms of Fiction Novels

The Magic of Fiction Novels The Magic of Fiction Novels Fiction novels have a unique ability to transport readers to...

The Enchantment of Fiction Novels: A Journey into Imagined RealmsThe Enchantment of Fiction Novels: A Journey into Imagined Realms

The Magic of Fiction Novels The Magic of Fiction Novels From the enchanting realms of fantasy to the gripping mysteries...

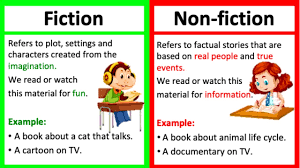

Unveiling the Magic of Fiction: A Journey into Imaginary RealmsUnveiling the Magic of Fiction: A Journey into Imaginary Realms

The Allure of Fiction: Exploring Imaginary Realms The Allure of Fiction: Exploring Imaginary Realms Fiction, with its boundless creativity and...

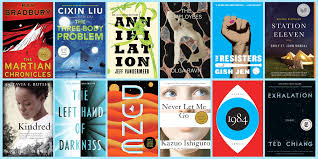

Exploring the Boundless Universe of Science FictionExploring the Boundless Universe of Science Fiction

The Fascinating World of Science Fiction The Fascinating World of Science Fiction Science fiction, often abbreviated as sci-fi, is a...

Discover the Finest Science Fiction and Fantasy Books for Your CollectionDiscover the Finest Science Fiction and Fantasy Books for Your Collection

Best Science Fiction Fantasy Books The Best Science Fiction Fantasy Books That Will Transport You to Other Worlds Science fiction...

Unveiling the Finest Science Fiction and Fantasy BooksUnveiling the Finest Science Fiction and Fantasy Books

Exploring the Best Science Fiction and Fantasy Books Exploring the Best Science Fiction and Fantasy Books Science fiction and fantasy...

Exploring the Enchanting Realms of Science Fiction and Fantasy BooksExploring the Enchanting Realms of Science Fiction and Fantasy Books

The Enchanting World of Science Fiction and Fantasy Books The Enchanting World of Science Fiction and Fantasy Books Science fiction...

Unveiling the Wonders of Science Fiction ArtworkUnveiling the Wonders of Science Fiction Artwork

The Fascinating World of Science Fiction Artwork The Fascinating World of Science Fiction Artwork Science fiction artwork is a captivating...