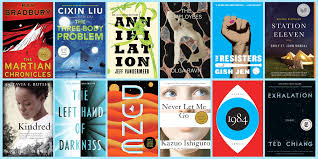

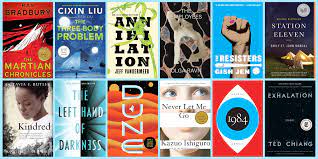

Best Science Fiction Fantasy Books The Best Science Fiction Fantasy Books That Will Transport You to Other Worlds Science fiction...

Unveiling the Finest Science Fiction and Fantasy BooksUnveiling the Finest Science Fiction and Fantasy Books

Exploring the Best Science Fiction and Fantasy Books Exploring the Best Science Fiction and Fantasy Books Science fiction and fantasy...

Exploring the Enchanting Realms of Science Fiction and Fantasy BooksExploring the Enchanting Realms of Science Fiction and Fantasy Books

The Enchanting World of Science Fiction and Fantasy Books The Enchanting World of Science Fiction and Fantasy Books Science fiction...

Unveiling the Wonders of Science Fiction ArtworkUnveiling the Wonders of Science Fiction Artwork

The Fascinating World of Science Fiction Artwork The Fascinating World of Science Fiction Artwork Science fiction artwork is a captivating...

Exploring the Boundless Realms of Sci-Fi and FantasyExploring the Boundless Realms of Sci-Fi and Fantasy

The Enchanting World of Science Fiction and Fantasy The Enchanting World of Science Fiction and Fantasy Science fiction and fantasy...

Unleashing the Wonders of Sci-Fi Art: A Visual Odyssey into Futuristic RealmsUnleashing the Wonders of Sci-Fi Art: A Visual Odyssey into Futuristic Realms

The Fascinating World of Sci-Fi Art The Fascinating World of Sci-Fi Art Science fiction art, often abbreviated as sci-fi art,...

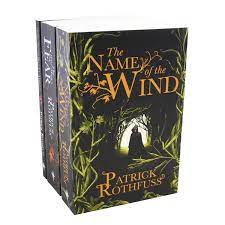

The Long-Awaited Revelation: Kingkiller Chronicles Book 3 UnveiledThe Long-Awaited Revelation: Kingkiller Chronicles Book 3 Unveiled

The Anticipation of Kingkiller Chronicles Book 3 For fans of Patrick Rothfuss’ epic fantasy series, the wait for the third...

The Enigmatic Journey Continues: Unveiling Patrick Rothfuss Book 3The Enigmatic Journey Continues: Unveiling Patrick Rothfuss Book 3

The Long-Awaited Arrival: Patrick Rothfuss Book 3 The Long-Awaited Arrival: Patrick Rothfuss Book 3 Patrick Rothfuss, the acclaimed author of...

Unveiling the Enchantment of Science Fiction BooksUnveiling the Enchantment of Science Fiction Books

The Fascinating World of Science Fiction Books The Fascinating World of Science Fiction Books Science fiction, often abbreviated as sci-fi,...

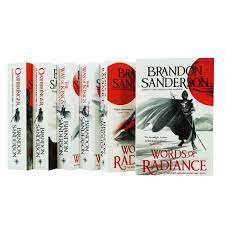

Discover the Enchanting Worlds of Brandon Sanderson BooksDiscover the Enchanting Worlds of Brandon Sanderson Books

Exploring the World of Brandon Sanderson Books Exploring the World of Brandon Sanderson Books Brandon Sanderson, a prolific author in...