The Importance of Funds in Achieving Financial Goals

Whether you are saving for a specific purpose or building long-term wealth, funds play a crucial role in helping individuals and businesses achieve their financial objectives. Funds, also known as investment funds or mutual funds, pool money from multiple investors to invest in a diversified portfolio of assets such as stocks, bonds, and other securities.

One of the key advantages of investing in funds is diversification. By spreading investments across various asset classes and sectors, funds help reduce risk and volatility compared to investing in individual securities. This diversification can provide more stable returns over time and protect investors from significant losses due to market fluctuations.

Another benefit of funds is professional management. Fund managers are experienced professionals who make investment decisions on behalf of fund investors. They conduct research, analyse market trends, and adjust the fund’s portfolio to maximise returns while managing risk. This expertise can be especially valuable for investors who may not have the time or knowledge to actively manage their investments.

Funds also offer liquidity, allowing investors to buy or sell shares at any time based on the fund’s net asset value (NAV). This flexibility provides investors with easy access to their money when needed, unlike certain types of investments that may have restrictions on when you can cash out.

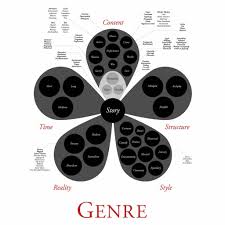

Furthermore, funds can be tailored to suit different investment goals and risk profiles. Whether you are looking for growth opportunities, income generation, or capital preservation, there are various types of funds available to meet your specific needs. From equity funds that focus on stocks to bond funds that invest in fixed-income securities, there is a wide range of options for investors to choose from.

In conclusion, funds are powerful tools that can help individuals and businesses grow their wealth over time. By providing diversification, professional management, liquidity, and customisation options, funds offer a convenient and effective way to achieve financial goals while managing risk. Consider incorporating funds into your investment strategy to take advantage of these benefits and work towards a secure financial future.

Essential Tips for Choosing and Managing Investment Funds

- Set clear investment goals before choosing a fund.

- Diversify your investments by choosing funds from different sectors or regions.

- Consider the fees and charges associated with the fund to maximize returns.

- Regularly review and monitor your funds’ performance to ensure they align with your goals.

- Understand the risk level of the fund you are investing in to manage your overall portfolio risk.

- Consult with a financial advisor if you are unsure about which funds to invest in.

Set clear investment goals before choosing a fund.

Before selecting a fund, it is essential to establish clear investment goals. By defining your objectives upfront, such as capital growth, income generation, or capital preservation, you can align your investment strategy with your financial aspirations. Setting clear investment goals helps you determine the appropriate type of fund that best suits your needs and risk tolerance. Whether you are aiming for long-term wealth accumulation or seeking regular income streams, having a well-defined investment objective ensures that you select a fund that aligns with your financial priorities and maximises the likelihood of achieving your desired outcomes.

Diversify your investments by choosing funds from different sectors or regions.

Diversifying your investment portfolio by selecting funds from various sectors or regions is a smart strategy to spread risk and potentially enhance returns. By investing in funds that cover different industries or geographic areas, you can reduce the impact of market fluctuations on your overall portfolio. This approach helps to capture growth opportunities in diverse markets while mitigating the impact of downturns in any single sector or region. Additionally, diversification through funds can provide exposure to a broader range of investment opportunities and increase the resilience of your portfolio against unforeseen events specific to a particular sector or region.

Consider the fees and charges associated with the fund to maximize returns.

When investing in funds, it is essential to carefully consider the fees and charges associated with the fund to maximise returns. While fees may seem small individually, they can significantly impact your overall investment performance over time. By understanding and comparing the fees of different funds, investors can make informed decisions that align with their financial goals. Opting for funds with lower fees can help increase the net returns on your investments, allowing you to achieve better results in the long run. Therefore, conducting thorough research on fee structures and choosing cost-effective options can be a prudent strategy to enhance the profitability of your investment portfolio.

Regularly review and monitor your funds’ performance to ensure they align with your goals.

It is essential to regularly review and monitor the performance of your funds to ensure they are in line with your financial goals. By keeping a close eye on how your investments are performing, you can make informed decisions about whether adjustments need to be made to stay on track towards achieving your objectives. Monitoring your funds allows you to assess their progress, identify any underperforming assets, and take proactive steps to optimise your investment portfolio for long-term success.

Understand the risk level of the fund you are investing in to manage your overall portfolio risk.

Understanding the risk level of the fund you are investing in is essential for effectively managing your overall portfolio risk. By assessing the risk associated with a specific fund, you can align it with your investment goals and risk tolerance. Different funds have varying levels of risk, depending on factors such as asset allocation, market volatility, and investment strategy. By being aware of these risks, you can make informed decisions about where to allocate your funds to create a diversified portfolio that balances potential returns with the level of risk you are comfortable with.

Consult with a financial advisor if you are unsure about which funds to invest in.

It is advisable to seek guidance from a financial advisor if you are uncertain about which funds to invest in. A professional advisor can assess your financial goals, risk tolerance, and investment timeline to recommend funds that align with your objectives. By leveraging their expertise and insights, you can make informed decisions that maximise the potential for growth while mitigating risks. Consulting with a financial advisor can provide valuable clarity and peace of mind as you navigate the complex landscape of fund investments.